The Most Comprehensive Guide to Property Insurance: Coverage, Forms, Types, and More – Types of Home Insurance

The Most Comprehensive Guide to Property Insurance: Coverage, Forms, Types, and More

Are you in need of a comprehensive guide to property insurance?

You’re not alone! With the right knowledge, anyone can find and purchase affordable coverage.

But how do you choose among all those options out there? Where should you start looking for information on fire insurance, earthquake damage prevention, or flood protection policies? If this is your first time tackling these questions then take my advice: get yourself an automatic coffee machine. That way when it comes time to make decisions about buying property insurance, you can just keep on brewing.

My advice is to stay informed and read up on the most comprehensive guide out there: this one!

What is Property Insurance? Is it the Same as Home Insurance Coverage?

Property insurance is a type of insurance that protects your belongings from damage, theft, or other incidents. It is regulated by state law and may vary by state. The insurance company pays the premiums each month or year.

Property insurance is a type of insurance that protects your belongings from damage, theft, or other incidents. It is regulated by state law and may vary by state. The insurance company pays the premiums each month or year.

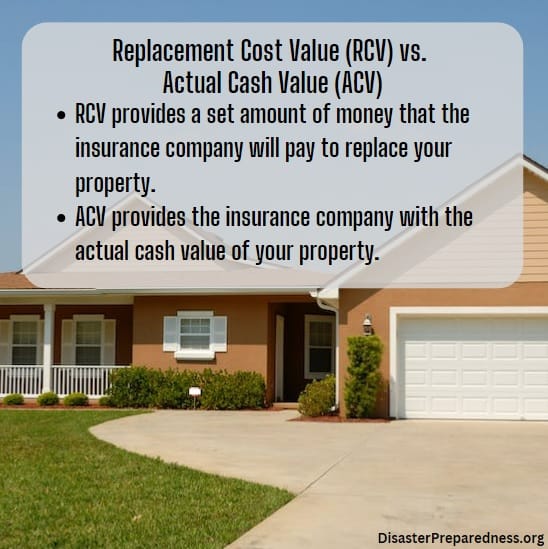

There are two types of property insurance: replacement cost value (RCV) or actual cash value (ACV). RCV provides a set amount of money that the insurance company will pay to replace your property, while ACV provides the insurance company with the actual cash value of your property.

Your policy will likely include a deductible. If you choose a higher deductible, your insurance policy may cost less. Property insurance provides coverage for accidents that happen on your property, as well as damage done by guests or people who live with you. Liability coverage can help you cover costs for medical expenses and property damage.

Do I Need Property Insurance?

You may need property insurance for a variety of reasons, including if you live in a safe area. Property insurance can help protect your home or business from damage or loss due to events like fire, theft, or vandalism. It can also provide financial assistance if you need to rebuild or replace your property.

The following items can help keep your family safe during a disaster:

The Lifestraw Water Filter is highly effective in removing harmful bacteria and parasites from water. Its microfiltration membrane eliminates 99.99% of waterborne bacteria, such as E. Coli and Salmonella, as well as 99.99% of waterborne parasites like Giardia and Cryptosporidium.

This weather radio is equipped with 5 different power sources, making it the ideal choice during prolonged power outages. The hand crank, solar panel, and AC power options make it easy to keep the radio running.

This power bank has a large cell capacity of 36800mAh, which is made possible by the use of industry-leading high-density lithium polymer cells. It is compact and has a high-quality, high-density battery that can support thousands of charge cycles.

What is Replacement Cost Property Insurance?

Replacement cost property insurance is a type of insurance that pays for the replacement of your property in the event that it is damaged or destroyed. The insurance company will cover the full cost of repairing or replacing the dwelling, even if the policy limits have been reached. This is helpful in cases of natural disasters or when prices for supplies jump.

Actual cash value coverage vs. replacement cost coverage:

There are two types of property insurance coverage: actual cash value and replacement cost. Actual cash value coverage pays for the replacement cost of the property, without taking into account depreciation. Replacement cost coverage pays the value of the home when it was first purchased, without any deduction for depreciation.

What does property insurance cover?: Covered perils

Property insurance typically covers wind and hail damage. In some cases, it may also cover other types of damage, such as fire or water damage.

What is Actual Cash Value Property Insurance?

Actual cash value coverage pays for the replacement of the structure or belongings, without any deduction for depreciation.

Replacement cost coverage pays for the purchase of the damaged item at its original price, no deduction for depreciation.

Extended replacement cost coverage pays for the purchase of the damaged item at its original price, plus a percentage increase for inflation.

What is Extended Replacement Costs Property Insurance?

Extended Replacement Costs Property Insurance pays the full cost of replacing the property, plus any additional costs due to depreciation. The insurance company will cover the full cost of repairing or replacing a damaged dwelling, even if the policy limits are exceeded. This can be helpful after a natural disaster or when prices for supplies rise suddenly.

Types of Property Insurance

Homeowners Insurance

Homeowners insurance is a type of property insurance that protects a home from damage or loss. It is usually required by mortgage lenders, and can cover accidental injury or death, as well as damage to the property itself. Homeowners insurance can also include coverage for tenants, condominium unit owners, and more.

Protect Your Home with Liberty Mutual. Get Affordable Home Insurance You Can Trust.

Renters Insurance

Renters insurance is a type of insurance that provides coverage for a renter’s belongings and liabilities. Renters insurance is available for anyone renting a single-family home, apartment, duplex, condo, studio, loft or townhouse. Renters insurance policies can be purchased online or in-person.

Renters insurance is important because it can help protect your belongings in the event that they are damaged or stolen. Additionally, renters insurance can help cover your expenses if you are held liable for damages to your rental unit or someone else’s property.

Get Renters Insurance As Low As $5 a Month. Quote with Liberty Mutual Today!

Condo/Townhouse Insurance

Condo/townhouse insurance is a type of property insurance that covers the exterior of a condominium or townhouse, as well as the internal structural elements. The amount of coverage and the price of the policy will depend on factors such as the covenants, conditions and restrictions (CC&Rs), declarations, and the association’s insurance policy.

Mobile Home Insurance

Mobile home insurance is a type of insurance specifically designed to cover mobile homes. Mobile homes are typically defined as dwellings that are built in a factory and then transported to their permanent location, as opposed to being constructed on-site.

Mobile home insurance typically covers the dwelling itself, as well as any attached structures and personal belongings. Coverage may also extend to include liability protection in the event that someone is injured while on your property.

Flood Insurance

Flood insurance is an extra layer of protection that covers dwellings for losses caused by flooding. Flood insurance policies are different from basic hazard insurance, which covers water damage from burst pipes and toilets. Homeowners insurance does not normally include flood coverage. You must purchase flood insurance separately.

Why do you need flood insurance? Because floods can happen anywhere, even in areas that are not considered high-risk for flooding. In fact, floods are the most common natural disaster in the United States. And just a few inches of water can cause tens of thousands of dollars in damage to your home or business.

If you live in a high-risk area for flooding, your mortgage lender will likely require you to have flood insurance. Even if you don’t live in a high-risk area, it’s still a good idea to have flood insurance because it’s not covered by most homeowners policies.

There are two types of flood insurance: National Flood Insurance Program (NFIP) policies and private policies. NFIP policies are backed by the federal government and are available through participating insurers in communities that participate in the NFIP program. Private policies are offered by some insurers and may provide coverage beyond what’s available under an NFIP policy.

If you’re considering flood insurance, talk to your insurance agent or company to find out what’s available in your area.

Earthquake Insurance

Earthquake insurance is designed to cover damage from earthquakes. Damage from earthquakes is not usually covered by homeowners insurance policies. Earthquake insurance can help protect your home and belongings in the event of an earthquake.

Consider purchasing the following items in case of an earthquake:

This furniture safety strap set is made of heavy-duty metal cleats, wall brackets, and fasteners, as well as triple-stitched nylon webbing, and can support up to 400 lbs. These wall straps do not have any weak links in the form of plastic components or glue, making them reliable for anchoring furniture.

This product is ideal for securing antiques, collectibles, and other fragile items from falling. It works on almost any surface and is easy to apply due to its pliable texture.

These secure straps can be easily adjusted up to 21 inches long to hold bookcases, dressers, and other large furniture items upright. For added safety, use two straps for each item and three for taller or heavier furniture pieces.

How To Get Property Insurance

There are many things to consider when you’re shopping for property insurance. It’s important to find an insurance policy that covers your home and belongings in the event of a disaster. Here are a few tips to help you get the best coverage for your needs:

1. Schedule time to shop around for property insurance. You can enlist the help of an insurance broker, or shop around on your own. Make sure you compare quotes from different insurers before making a decision.

2. Be prepared to answer questions about your home, including its construction date and any updates. Your insurer will use this information to determine the amount of coverage you need.

3. Decide which type of property insurance you need and what coverage you want. There are different types of policies available, so make sure you choose one that meets your needs. You may want to add earthquake, flood, or valuable item coverage to your policy.

4. Review the company’s complaint or customer service record before buying a policy. This will give you an idea of how they handle claims and customer service issues.